Edit Content

GyrusAIM

- Pricing

- Free Trial

- Request For Proposal

- Support

- Compare

Features

- All Features

- Assessments

- Certifications

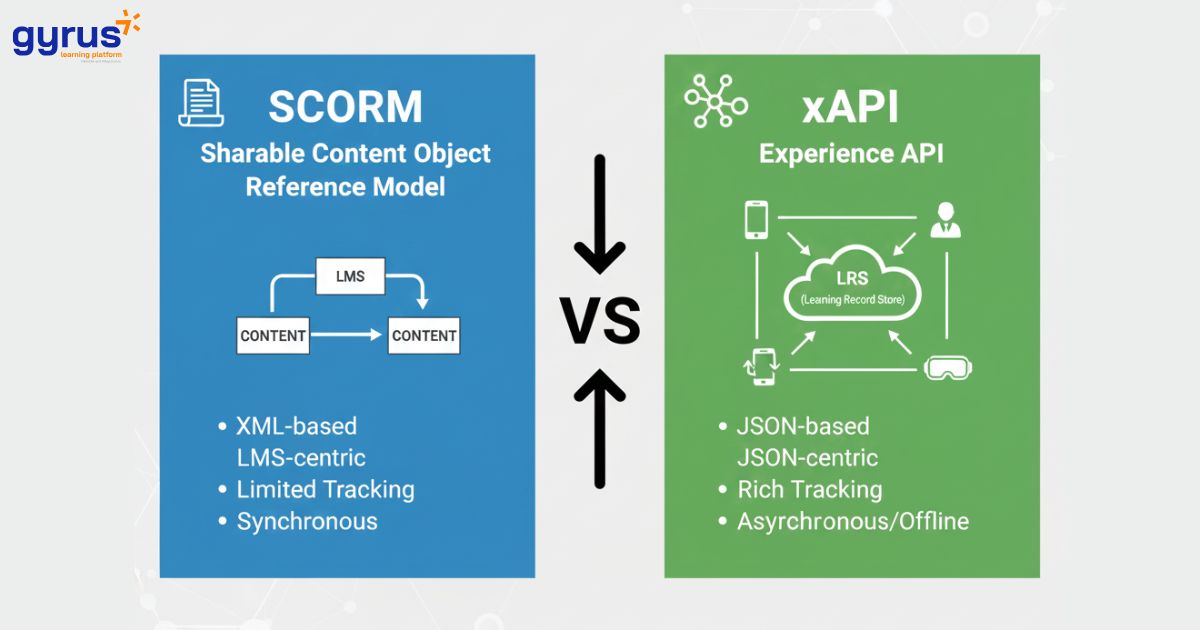

- SCORM Compliant LMS

- Evaluations

- Gap Analysis

- Self Hosted LMS

- Multilingual

- Advanced Reporting

- 21 CFR Part 11

- SF 182

- Instructor Led Training

- Class Management

- Training Management Systems

- Cloud Hosted LMS

- Validated System

- Self-Reported Training

- Automation

- Blended Learning

- Learning Paths

- Admin Pain Points

- LMS Content Library